42% of the world’s Internet users live in Asia

India’s Micromax eyes Russia and Eastern Europe as new smartphone markets

Intel Capital has so far invested over $2 billion in Asian startups

The Change School in Bali helps entrepreneurs slow down to speed up

Corsair hosts the first ever Corsair Asia Cup, registrations now open

Corsair is stepping into the Dota 2 eSports scene with the first-ever Corsair Asia Cup. The tournament will feature 12 qualifying teams and the following invited teams:

- MVP (Korea)

- Titan (Malaysia)

- Scythe (Singapore)

- Orange (Malaysia)

- Arrow (Malaysia)

- Mineski (Philippines)

- Zephyr (Korea)

Check out the following tournament poster for qualifier information:

The Corsair Asia Cup will also have the following prizes:

Interested teams may register here.

According to the announcement, the main event of the tournament will be streamed online via the Corsair Asia Cup website. The tournament will also have an in-game ticket. The price has yet to be announced.

This post Corsair hosts the first ever Corsair Asia Cup, registrations now open appeared first on Tech in Asia.

How two Sri Lankans are building a robotic cloud in Switzerland and Japan

The robot from Laputa, the Studio Ghibli island in the sky, and inspiration for Rapyuta’s name.

As the robotics industry gains steam, one question is looming large: how do you make and where do you put robot brains? The hardware of robotics is the obvious challenge, but without the right software a robot is a lifeless hunk of metal. And without an internet connection, even the best software is little more than a definition of the machine’s limits rather than its possibilities. That is why leading tech companies in Japan like Yahoo Japan and SoftBank are creating cloud infrastructure for robotics software. They might be giants, but that has not deterred Rapyuta Robotics, a Japan-Switzerland startup from joining the race.

Dr. Gajamohan Mohanarajah (CEO) and Arudchelvan Krishnamoorthy (COO), two long-time friends from Sri Lanka who studied abroad together at the Tokyo Institute of Technology, co-founded the startup. Rapyuta Robotics – named after the robots featured in a famous Hayao Miyazaki film – aims to create a cloud infrastructure that will allow all robots connected to it to share each others experiences. This reduces the amount of programming that needs to go into the robot initially and means that all connected robots should get progressively more adaptable.

Proving this concept is a heavy challenge. Rapyuta Robotics’ engineering team is developing the robot-based and cloud-based code from scratch. It’s a no-shortcuts approach and it is getting ready to hit the market.

Entering via drones

The first product Rapyuta Robotics is looking to roll out is drones for security and infrastructure inspections. Surveying parking lots and private property is an obvious application of drone technology, but Rapyuta Robotics feels that the infrastructure market is just as promising.

Bridges, tunnels, and other major structures need to be regularly examined. Careful review can be dangerous work, which is why Rapyuta Robotics is programming its drones to carry out the inspections. They fly close to the structure, take pictures, and can access the cloud to compare the current snapshot to previous ones taken in the same location.

Getting pictures taken from the exact same spot, close enough to a large object that one wrong move can impair the drone is too difficult for humans. Rapyuta Robotics’ drones can be programmed to carry everything out autonomously.

That’s also possible indoors. “Everyone flies drones outside because it is easy to get the GPS signals and get the positioning. But, when it comes to indoors, you are not going to get the signal, you need to create a virtual GPS field. Our speciality is that we can create that field for a really cheap price,” Krishnamoorthy explains.

Though drones are the company’s first product, Krishnamoorthy stresses that Rapyuta Robotics is much more. “For now we are focusing on drones, but we are a robot company. Right now we are using flying robots,” he says.

Rapyuta says its technology will make its drones better than out of the box alternatives.

Funding a dream team

Krishnamoorthy is a serial entrepreneur. After earning a master’s degree in financial mathematics from Columbia University and working for Nomura Securities, he co-founded Fund of Tokyo, a global macro hedge fund. Working primarily out of Japan, he is the startup’s business leader.

Dr. Mohanarajah moved to Switzerland after finishing his undergraduate studies in Tokyo. There, he earned a Ph.D. from the Swiss Federal Institute of Technology in Zurich while working on RoboEarth, a pre-cursor of Rapyuta Robotics’ cloud technology. He has also achieved YouTube fame for creating Cubli, a cube that can jump up from a resting position to balance perfectly on one corner.

The rest of the eight-person team is similarly credentialed, with many coming over from the RoboEarth project. The technical side of the startup remains stationed in Switzerland, while Krishnamoorthy works on the business side in Japan.

“You need a really good internet connection to do cloud robotics. Japan and Korea are two of the top countries for internet speed and infrastructure,” he says, explaining why Rapyuta Robotics chose Japan. That’s not to say Europe is entirely forgotten. “In parallel we are going to focus some of the business in Europe, particularly with wind-farm inspections,” he adds.

So far, he’s got the attention of investors. This January, Rapyuta Robotics scored JPY 351 million (US$2.95 million) in seed funding (PDF link) before it could even show off a complete prototype.

The funding came after eight months of bootstrapping the project. Cyberdyne, a Japanese robotics company, led the investment and was joined by SBI Investments, Fuji Creative Corporation, and V-Cube.

With a summer target for having the complete prototype, Krishnamoorthy is on the lookout for more investments. This time he expects the final amount to be “double digit millions” in US dollars.

This post How two Sri Lankans are building a robotic cloud in Switzerland and Japan appeared first on Tech in Asia.

Rocket Internet has a go at job classifieds with launch of Everjobs

Rocket Internet churned out a new startup today with the launch of Everjobs. It’s a jobs classifieds site that launches first in Sri Lanka and Myanmar.

Though the name is new, the site actually stems from Rocket’s own Work.com.mm, the Myanmar-only jobs site that rolled out in June 2012. That gives Everjobs a rolling start in Myanmar. Everjobs co-founder Ronald Schuurs tells Tech in Asia that the Myanmar site – which will retain its old name and URL for the time being – is now getting 150 new job-seekers signing up each day, 140,000 unique visits per month, and it just crossed one million monthly page-views.

Schuurs says that the Myanmar site reached that milestone with mostly organic, word-of-mouth growth, though Rocket Internet is now chasing after new users in the country with online advertisements. He anticipates quicker growth for Everjobs in Sri Lanka thanks to more widespread web usage. “We want to be faster [… and] a bit more ambitious than we were with Myanmar.”

New frontiers

Schuurs says that the Everjobs launch in these two nations fits in with Rocket Internet’s strategy of looking to seize fast growth in what he calls “frontier markets” – places like Myanmar, Pakistan, or Bangladesh where web adoption is growing fast. “They’re a bit more overlooked compared to India or China,” he adds. And so Rocket Internet is looking ahead to the next few years of web growth, aiming to become the dominant player in a nascent market.

Everjobs already has 15 staffers in Myanmar thanks to the early start of Work.com.mm; so far in Sri Lanka it has three local personnel.

Everjobs will expand to more emerging markets in Asia in due course, but the next roll-out will be to an undisclosed nation in Africa in late March or early April.

Berlin-based startup dynamo Rocket Internet now has five startups operating in Myanmar: Carmudi, Lamudi, Kaymu, Everjobs, and Daraz. That last one is an Amazon-like ecommerce store that first started in Pakistan and then ventured into Myanmar late last year.

This post Rocket Internet has a go at job classifieds with launch of Everjobs appeared first on Tech in Asia.

12 international VC firms that have invested in South Asian startups

As smartphone usage booms across Asia and web services become more commonplace, private equity firms and venture capitalists are exploring the lucrative potential of the region. There are a number of global VC firms, especially in Silicon Valley that are keeping an eye on startups on the other side of the planet. Below we’ve identified some big-name VCs who have backed South Asian startups.

1. Morgenthaler Ventures

Morgenthaler Ventures has invested in over 300 companies around the world, including Apple. Since 2008, it has focused a lot more on venture capital investments and thus invested over US$400 million in various business ventures relating to IT and life sciences.

The company showed its confidence in Pakistan-born enterprise chat app Convo and invested US$5 million in it.

2. Sequoia Capital

Sequoia Capital is one of the world’s foremost venture capital firms, started in California in 1972 by Don Valentine, and is currently funding growth-stage companies around the world.

It is well known for having invested in some of the global IT giants of today including Google, Apple, Yahoo, and Amazon. The earliest investment by Sequoia in India was back in 2006 when it put US$20 million in Café Coffee Day over two years. Currently, Sequoia Capital India has as much as US$1.4 billion invested in a number of companies in the nation.

Sequoia has a special preference for technology companies that have India-US cross-border connections. The firm invests in consumer services, healthcare, energy, financial services, and a range of other sectors. Recently, Sequoia announced that it had raised US$530 million in its fourth India focused round of funding which will take its total investment in the country to US$2 billion.

3. ePlanet Capital

ePlanet Capital is a Silicon Valley-based global venture investment firm, with offices around the world. The firm has made more than 100 investments in 14 years and focuses on the sectors of internet services and applications, entertainment, and life sciences.

The firm invested in Pakistan’s Naseeb Networks, maker of a social networking site called Naseeb, and Rozee.pk, an online recruitment website. This Rozee funding is often thought of as the first international investment in a Pakistani web startup.

4. Global Founders Capital

Rocket Internet’s founders teamed up to start Global Founders Capital, which aims to invest seed funds as well as late-stage funding. This venture capital firm started with almost US$180 million and has already invested in a couple of internet businesses. Rocket Internet has focused on investing in lucrative internet businesses in South Asia, the Middle East, South America, and Africa. Its portfolio spans over 50 companies in almost 40 markets.

In Pakistan, Rocket Internet operates fast-growing services like Kaymu and Daraz.

5. Fenox Venture Capital

Fenox Venture Capital is a venture capital firm that is based in Silicon Valley and which has spread its roots globally through investments (disclosure: Fenox Venture Capital is an investor in Tech in Asia. See our ethics page for more information). The company usually focuses on working with emerging tech startups and companies and has assisted enthusiastic entrepreneurs in Asia, Europe, North America and the Middle East.

Fenox recently launched a US$200 million fund for the Bangladeshi IT and media sector. It aims not only to provide early stage funding for Bangladesh’s startups but also promises final round funding and other angel backing.

6. Nexus Venture Partners

Nexus Venture Partners is a Mumbai, India-based VC firm that is considered among the leaders in the local market. It backs growth stage companies either in its home nation or companies in the US that have products and technologies relevant to emerging markets.

Nexus Venture Partners invests in a wide variety of sectors, from technology, cloud storage and big data analytics to media and energy companies. Typically it makes six to eight investments in a year, investing up to US$10 million in early stage companies with a second round of investment based on how successfully a company has implemented its business plan. Nexus was started in December 2006 and currently has a stake in over 50 companies.

It has an estimated US$600 million under management. In 2012, Nexus raised a US$270 million fund to help Indian companies break into global markets as well as to support US-based companies focusing on India.

7. Nasscom

Nasscom is an IT and business-focused trade association in India. It’s not only a local organization but has global connections, with more than 1,200 members and over 250 global companies in collaboration from the US, UK, and Europe.

Nasscom’s member companies run the gamut, across IT products, infrastructure management, R&D services, ecommerce and web services, engineering services, offshoring, animation, and gaming. Therefore, it has made a lot of investments in the tech industry. A while back, Nasscom set up the 10,000 Startups program to bring angel investments, mentorship, and accelerator support. This initiative is being supported by Google, Microsoft, and Intel.

8. Ardent Capital

Ardent Capital was set up by entrepreneurs in Southeast Asia.. It has invested in a range of companies across Asia, including Sri Lanka’s Wow.lk, which has a 80 percent share of the ecommerce market in Sri Lanka. Ardent Capital is a young team, having only started in 2011 and is currently expanding its operations to invest in more early stage technology companies in the region.

9. Frontier Digital Ventures

Frontier Digital Ventures is a Malaysia-based VC that has a prime focus on investing in classifieds and listings businesses. The firm is active in Pakistan where it has invested in Pakwheels and Zameen. Frontier DV invested almost US$3.5 million in Pakwheels; its undisclosed investment in Zameen means it has a significant but non-controlling share in the property listings site.

10. Kima Ventures

Self-styled as the most active angel investors in the world, Kima Ventures has made more than 300 investments in almost 290 companies. This French VC funds with seed capital in promising startups.

Its investment portfolio is quite diverse, in which it has made investments of more than $15 billion. The firm identified the potential in the Pakistan-made, globally-focused Groopic and invested a six-figure sum in the fun photo app.

11. Etohum

Etohum is an Istanbul, Turkey-based startup accelerator program that provides funding to tech startups. The firm has been investing seed money since 2008 and has invested over US$40 million in more than 35 startups and companies.

It spotted and backed the Pakistani app Bookme, a mobile app for booking movie tickets. The accelerator’s crew saw Bookme at the Startup Istanbul event and expressed its willingness to fund the startup.

12. Naspers

South Africa-based Naspers has invested in a lot of companies related to ecommerce, online services, print media, and pay television. More than 80 percent of the strategic investments that Naspers does is in India.

The biggest name Naspers has backed is Flipkart. The homegrown Indian ecommerce giant was initially funded with US$100 million, but it has since raised US$1.75 billion in total. The company has also made significant investments in the popular classifieds site OLX.

For a better international investment ecosystem for the region, it would be highly beneficial if the governments across South Asian nations develop a forum to lure global VCs to the region. With a strategic location, inexpensive labor, a large base of consumers, and quality technical education, tech startups have a lot to contribute to these countries’ economic growth.

A version of this post was first published on Techjuice, a Tech in Asia content partner.

This post 12 international VC firms that have invested in South Asian startups appeared first on Tech in Asia.

Asia’s mobile and broadband internet speeds, in one infographic

How fast is your internet? How much does it frustrate you? Although you likely have a few options for your broadband and mobile data plans, the answers to those questions are largely dictated by which country you’re in.

Data for the latest broadband and cellular speeds across Asia-Pacific reveal that Singapore, Hong Kong, and Japan come out ahead in the home broadband race, but the picture is very different for those out of the house on their smartphones. It’s actually New Zealand, China, and Taiwan that surge ahead in mobile data speeds. The web speed data comes from Ookla’s Net Index, and then we’ve turned all those facts and stats into the infographic you see below.

While Asia beats the global average on broadband speeds, there’s still a huge difference between the haves and the have-nots. Singapore is blazing ahead on an average speed of 118.8 Mbps on broadband, but the Philippines is limping along at 3.6 Mbps. Even worse is that while Singapore’s fixed-line speeds have nearly doubled in the past year, the speed in the Philippines inched up a meager six percent in the past 12 months.

It’s a similar story of woe when it comes to Asia’s cellular speeds. While mobile data in New Zealand and China zooms along at an average of 27.7 and 27.6 Mbps respectively as 4G has caught on in a big way in both nations in the past year, people in Vietnam are staring at blank white pages on their smartphones as data trickles out at just 1.9 Mbps.

Here’s the full infographic:

This post Asia’s mobile and broadband internet speeds, in one infographic appeared first on Tech in Asia.

This Indian VC is looking toward Indonesia for early stage startups

Japanese investors like SoftBank, CyberAgent Ventures, Rebright Partners, and IMJ Investment Partners have established solid footing in Indonesia. So have big Chinese internet firms like Baidu. Even Korea’s Daum Kakao and startup gobbler Yello Mobile have made position plays in Jakarta.

More surprising, however, is the arrival of Indian players. In recent years, direct foreign investment into Indonesia from China and India has increased significantly, despite Forbes calling India the world’s best-performing emerging market last year. One Indian VC fresh off the boat in Indonesia is Mumbai-based Aavishkaar, a compay whose LPs consist entirely of European-based development finance institutions.

In India, Aavishkaar is known for backing nearly 44 startups. Although not limited to the tech sector, some of its notable portfolio companies include a low-cost Indian hospital chain called Vaatsalya and Milk Mantra, a dairy company that sources from smallholder farmers.

Aavishkaar’s Bali-based senior investment manager Adi Sudewa tells Tech in Asia his firm recently locked in US$45 million to start Aavishkaar Frontier Fund (AFF), a pool of money that will focus only on markets outside India. Sudewa is tasked with hunting for early stage startups in four separate markets: Pakistan, Sri Lanka, Bangladesh, and Indonesia.

“We project a total of US$75 million for the fund,” explains Sudewa. “There’s no fixed proportion dedicated for each country, but we expect Indonesia to contribute a significant number of portfolio companies.”

But why Indonesia?

Pakistan makes sense for Aavishkaar, as it likely has a great deal of low-hanging fruit in the form of a large population of more than 182 million, more than 10 percent of whom are already on social media like Facebook. With ecommerce taking off in the country, Rocket Internet has set up shop with its marketplace Daraz (the Pakistani equivalent to Lazada). Daraz’s relative traction has created validation for Pakistan’s ecommerce potential, which has led other company builders to begin eyeing the market.

Bangladesh is another big one, with more than 160 million people, a US$175 billion economy, and a per capita income of US$1,190.

Sri Lanka on the other hand is a smaller market, with a population just more than 20 million and an internet penetration a little over 22 percent. Perhaps AFF sees Sri Lanka as a petri dish which can potentially birth startups that will go regional.

Indonesia represents a large opportunity for any startup investor, but culturally and geographically speaking, the archipelago is not terribly similar to India. Sri Lanka, Pakistan, and Bangladesh on the other hand, all directly border the second-largest Asian nation. This arguably makes them more familiar territories for an Indian VC like Aavishkaar. In that respect, a move into Indonesia doesn’t seem to make a whole lot of sense for the foreign firm, despite its inherent market potential.

Hunting for immaturity

Regardless, Sudewa says AFF has a keen eye on tech innovation, but is specifically looking for seed and series A startups in agriculture, healthcare, education, water and sanitation, renewable energy, and more. “Technology for development is an area that is very interesting,” he adds. “If there are fintech, edtech, or healthtech companies […] that aim to solve social and economic issues of people in the lower-income segment, those could be good fits for our fund.”

In India, early stage investment is already big and relatively mature industry. Hence there are a range of startups which focus on Indian and international opportunities. It’s not uncommon to see low-cost hospital chains, solar companies, microfinance, or drip irrigation companies receiving series B, series C investments, or even going to IPOs. Here [in Indonesia], the industry is not in that stage yet, although we believe the potential of Indonesian startups is huge, and that’s why we are here.

Sizing up the archipelago

In Indonesia, Sudewa sees healthcare as a challenge Aavishkaar can address. According to him, healthcare is challenging because most local operators are still adjusting to the government’s new universal insurance scheme. In this respect, Sudewa is likely already speaking with firms like MeetDoctor, UDoctor, and KlikDokter.

However, he’s not shy about revealing the startups AFF is already keeping tabs on. He adds:

There are many Indonesian startups that we like. I personally like e-Fishery a lot, as both its commercial and impact potential are promising. The team is also fantastic. They have achieved so many things and won so many awards but are still humble and keeping open mind to new ideas. We would love to see more young Indonesians following their path.

AFF has been officially active in its key target markets since earlier this month. The firm doesn’t have a quota for investments in the archipelago, and currently, Sudewa is the only one on the ground in Indonesia on behalf of AFF. However, according to him, he has two partners stationed in Mumbai, who fly in regularly to help prospect for interesting companies.

This post This Indian VC is looking toward Indonesia for early stage startups appeared first on Tech in Asia.

Top 11 most popular websites in Sri Lanka

In the present age, you can find everything online. From where to buy to where to eat, you can find an online resource for all your needs on the infinite world of internet in Sri Lanka. Here is a list of the top websites that you can use to have a better overall experience.

1. Ikman.lk

This is the number one free online classified website. To finding the toaster in your kitchen or to sell the car in your garage, this platform gives you the ability to buy and sell anything you want. Ikman is considered to be the best platform for buyers and sellers to interact with each other. Simply post your ad or browse through the ones present and get your job done!

2. Hirufm.lk

With its launch in 1998, it took the whole country by storm. It has positioned itself in the number one slot in the Sinhalese market and over the period of a few years it has been rated as the most preferred Sinhala Channel. With its large and loyal listenership, it is the most favored radio channel in Sri Lanka.

3. Facebook.com

Almost everyone in Sri Lanka is on Facebook. Whether it is to share their pictures, upload a status, have an intense discussion on a social issue or catch up on old friends, this is the answer to everything. Facebook is considered to be the most used social media platform by the people of Sri Lanka.

4. Google.lk

The first thing that a person opens on their laptop is Google. You can search the vast world of internet, check your platforms, use Gmail to send and receive emails or use other services provided by them to make your connectivity experience worthwhile. Many business even use it to promote themselves and use their facilities.

5. Kaymu.lk

This is the number one online marketplace where sellers post their ads and buyers can look for what they want. Kaymu is the one stop shop for all your buying needs as it has a large number of items for sale at attractive prices and amazing discounts. Moreover, it provides free cash on delivery and buyer security to its customers.

6. Ebay.com

EBay is an online auction and shopping website that links buyers and sellers together. Individuals or businesses can sell a wide variety of goods to a large number of buyers online. Anything that you can imagine is available here and it is simply just a click away. The products are authentic and of high quality.

7. Hirunews.lk

Whether you want to find about the latest breaking news or want to check the currency valuation, Hiru news has all the information you need on all local and international matters taking place. It is the most popular online news portal that broadcasts in Sinhalese, Tamil and English.

8. Yamu.lk

A group of people started this venture three years back and within a few years it is one of the most visited sites when it comes to finding what is good in the city of Colombo. There is a large amount of information available on restaurants, bars and other places that can be a much needed and helpful guide to have an entertaining time.

9. Topjobs.lk

This is the best place for every active job seeker to find the opportunity they need. Small to large companies advertise their posts and people can view them making it the best platform for employers and potential employees to interact with each other.

10. Espncricinfo.com

ESPNcricinfo is one of the world’s leading websites that provides up to date and immediate information regarding the world of cricket. It comes to be the number one in five of the single sport online websites in the world. It provides ball to ball coverage of Test and One day matches to its vast viewer base.

11. Pinterest.com

Pinterest is a photo sharing website that people love to browse. The users can upload, save and sort images which are known as Pins with other users. There are different pinboards where you can upload your pictures according to categories and they can be saved easily. It is the perfect place to share your creativity with others like you.

This post Top 11 most popular websites in Sri Lanka appeared first on Tech in Asia.

Their startup survived a tsunami and Sri Lanka’s fledgling internet. Now it’s booming

It was in the early 2000s when a group of five young, ambitious high school graduates from Sri Lanka realized their burning desire to strike out on their own. They were enthusiastic about entrepreneurship and yearned to make it big – building a company synonymous with quality and excellence.

Despite barely being out of their teens, the five friends proceeded to register and launch their company, Vesess. They called themselves “The 5,” and their company logo was five fingers and a palm. Initially they dabbled in several fields, trying to test the waters and see what would stick. One of their early products was a Flash-based Valentine’s card, which they hoped would appeal to the younger generation of Sri Lankans.

The biggest stumbling block the entrepreneurs faced was that not many people in Sri Lanka used the internet. They understood this was the future and it made sense to invest their time and resources in building a tech company, but there was very little traction on the ground. Furthermore, attitudes towards entrepreneurship were not as widely-ingrained – bigger companies felt uncomfortable working with startups as they felt they didn’t have enough experience and exposure to be reliable partners.

Reality hit hard when they tried to market their proprietary financial application, called Investor. It was aimed at facilitating the transition from traditional stock brokerage processes to digital. People wanted applications to monitor trends and analyze data, so theoretically the product should have taken off. Unfortunately, prospective clients were not convinced of the company’s viability and the idea tanked.

Verge of collapse

Prabath Sirisena

Vesess faced an uncertain future. Some tough decisions needed to be made to ensure the firm stayed liquid and didn’t collapse. Cash flow issues meant they weren’t able to afford extravagant salaries and three of the original founders parted ways with the company, concentrating on their individual careers instead. The two who chose to stick it out were Lankitha Wimalarathna and Prabath Sirisena – currently the CEO and creative director of Vesess respectively.

Lankitha Wimalarathna

“We wanted to do something really beautiful – like Virgin. Build a brand which can be extended into any vertical […] We tried utilizing our skills in print design and web development but it was difficult and we almost collapsed,” explains Lankitha.

In 2004, Sri Lanka was hit by the huge Indian Ocean tsunami that brought death and widespread devastation. The entrepreneurs wanted to help their country recover from the disaster and Prabath had an idea to design a site which would assist in transmitting information. Within 24 hours, the duo had a small web page ready, which provided contact information for all humanitarian organizations and government agencies working on the ground for disaster relief. Their site quickly became the sole point of reference for anyone interested in assisting Sri Lanka recover from the disaster.

“We started getting responses and inquiries from everywhere in the world, particularly Western countries,” explains Prabath. “Anyone who wanted to help got in touch with us and that was the turning point for Vesess.”

Social good led to opportunity

Soon after the tsunami, Vesess landed its first international project – designing web pages for a British company. They were able to do a good job, and with word of mouth, the number of projects started to increase rapidly. Prabath explains they were active in forums and discussion groups across the internet and positioned themselves as a “standards-compliant” web design firm. This, he claims, helped Vesess immensely as they were able to build credibility.

But as Vesess scaled up, both Prabath and Lankitha started to understand other pain points. One major problem was the lack of an effective and smooth online payments gateway. As a Sri Lankan company, its international clients had to route payments through traditional mechanisms like banks. This meant heavy transaction costs, often about 10 percent of the total billed amount – a figure most clients were unwilling to pay. Fintech solutions like PayPal didn’t work in the country and the entrepreneurs knew this was a problem faced by many more.

“We went to local banks to find a solution but the situation was really bad. We were a young company and they were hesitant to give facilities to us. But we had the courage to look forward. We incorporated our company in the US and built a mechanism to facilitate payments,” recalls Lankitha.

What they came up with was Hiveage (previously Curtbee), an online billing, invoicing, and payments tool targeted at freelancers, “solopreneurs”, and small businesses. As they had the foresight to register their company in the US, they were able to integrate PayPal for a seamless experience.

In 2009 their product was featured on Lifehacker and yet again Vesess was propelled into the limelight. They got thousands of signups and inquiries from more payment providers. Finally banks were also interested in collaborating with them and were belatedly given permission to build their own SaaS model. Today, Hiveage serves 45,000 businesses in 140 different countries.

Constant innovation

Despite a steady stream of success, the entrepreneurs weren’t content just to sit back. Vesess’ new service, launched in September this year, is called Vgo – a cloud-based SaaS logistics technology platform that’s trying to help traditional taxi and logistics companies compete with disruptors such as Uber.

“We’ve always had the objective of going into enterprise SaaS and met with players in the logistics and transportation industry who were looking at the same lines […] Vgo provides necessary tools from dispatch to mobile applications as well as call center technologies so that companies can focus on their core business,” explains Lankitha.

Vgo started with seed funding of US$1 million, with Vesess one of a total of four investors who participated in the round. It’s already managed to snare several paying enterprise customers and Lankitha says they’re in discussion with many more. “The rate at which it has grown is great.”

The days of solely providing consultancy services are almost at a standstill – Lankitha says they’re very selective when it comes to projects now and prefer to concentrate on their proprietary solutions instead. Vesess currently employs a team of 15 people but they’re scaling aggressively as they see strong potential for Vgo. “In 5 years we want to become a platform-as-a-service company. We’re looking to expand our fleet and operations beyond the Sri Lankan context and also enter into an IPO in the near future.”

This post Their startup survived a tsunami and Sri Lanka’s fledgling internet. Now it’s booming appeared first on Tech in Asia.

6 years after a bloody civil war, Sri Lanka bets on startups, attracts investors

Sigiriya, Sri Lanka

When you visit Sri Lanka, it’s hard to imagine that the beautiful, teardrop-shaped island was once the ground of one of the bloodiest civil wars in history. Two ethnic groups – the majority Sinhalese and the minority Tamil – were engaged in a bitter war that claimed the lives of an estimated 100,000 people in thirty years.

Since the war ended in 2009, however, the country has seen massive change. Sri Lanka is now ranked 73rd in the world on the Human Development Index, higher than India at 135 and China at 91. Among the people of the island, this change has manifested itself in many different ways.

“I studied political science and did my masters in international relations,” says Lahiru Pathmalal, co-founder of Takas.lk, one of Sri Lanka’s largest ecommerce sites. Although Lahiru worked with NGOs and different conflict resolution organizations, he did not feel the dynamism necessary to change the face of the country. “It was all government work all over again,” he explains.

Takas.lk was founded in 2012 by Lahiru, Dilendra Wimalasekere, and Murtaza Moosajee. Its latest round of funding was US$500,000 led by local investors. Other competition in the sector includes Wow.lk, an ecommerce site that recently entered the ticketing space for Sri Lanka’s cricket team and expanded its site to read in Tamil, Sinhala, and English. Ikman.lk is a popular classifieds site that connects sellers and buyers all over Sri Lanka. Despite the growing presence of ecommerce, however, it is still in its very early stages.

“Our most difficult challenge has been raising money,” Lahiru says. “It’s hard to show a proof of concept. How do you explain to people that ecommerce is here to stay? It is changing ever so slowly, but people are still critical of the entire framework of the country.”

While it’s not always easy to compare countries – especially two that are so vastly different in size, geography, and climate – Sri Lanka and India do have a lot of similarities. “We’ve implemented a few similar techniques for our buyers,” explains Lahiru. “We were the first site to offer cash on delivery services here, as well as tie-up with certain banks to allow people to pay directly from their accounts.”

A large part of Sri Lanka’s population is already online. “We have 5 million out of 20 million people on the internet,” says Lahiru. “There are 4G colonies across the country and Google’s balloon project promises to get internet to every corner of the country in the next few years.”

Most products sold on the site are electronics goods and the concept of inventory stocking is still novel to Sri Lankan ecommerce. “We stock with the guarantee that we will sell our products within three days,” explains Lahiru. “We ship our things out immediately.” After a product reaches their site in the island’s capital, Colombo, Takas.lk’s internal logistics team handles the rest. “The only part we’ve outsourced is the last mile,” says Lahiru.

Investment in Sri Lanka is increasing

Colombo, the capital city of Sri Lanka

Despite Lahiru’s difficulties in raising money, the interest in Sri Lanka is starting to rise. Asia’s biggest economies have been looking at the island as a possibility. Its largest trading partners are India and China, in that order. The Chinese government was lending up to US$490 million to the country in 2012, with a 50-fold increase in the past decade.

When I spoke to Prajeeth Balasubramaniam, founder of the Lankan Angel Network and an investor in Takas.lk, he had just finished something that he called an “empowerment program hackathon.”

“We hold entrepreneurship programs around the country,” he said. “This one was in northern Sri Lanka, where much of the war happened. 80 percent of the startups were tech-related, and each year we fund one to two entrepreneurs. After that, we put them into an incubation and mentoring program.”

The Lankan Angel Network is an alliance of angel investors with 75 members, including the vice president of Google Southeast Asia and India, Rajan Anandan, and the president of the Indian Angel Network, Padmaja Ruparel. They’ve also funded companies like the Lanka BPO Academy, a higher education training academy in the IT and BPO (business process outsourcing) services, and Nithyarn, an online store for hand-woven, traditionally inspired products.

For Prajeeth, his investments are not focused on creating lifelong entrepreneurs. “We select entrepreneurs with the idea that they will be doing something else in five years,” he explains. “The ecosystem here is very young and we’re trying to make it grow. We have a finance team inside our incubation center that helps them project how to financially leave their company.”

The worst fear of an entrepreneur in an early ecosystem, Prajeeth says, is that the hard work people put into their ideas might be worthless when they are stolen and replicated. “It sounds ridiculous, but in the early stages of a startup ecosystem these things happen,” he says. “We’re trying to build trust. We’ve started the Venture Engine, an initiative where startups can find interested angel investors. It’s all about building an ecosystem where people can feel safe.”

What else can Sri Lanka do to promote its startup ecosystem?

This post 6 years after a bloody civil war, Sri Lanka bets on startups, attracts investors appeared first on Tech in Asia.

Social payments startup Kashmi is ready to launch with new seed funding

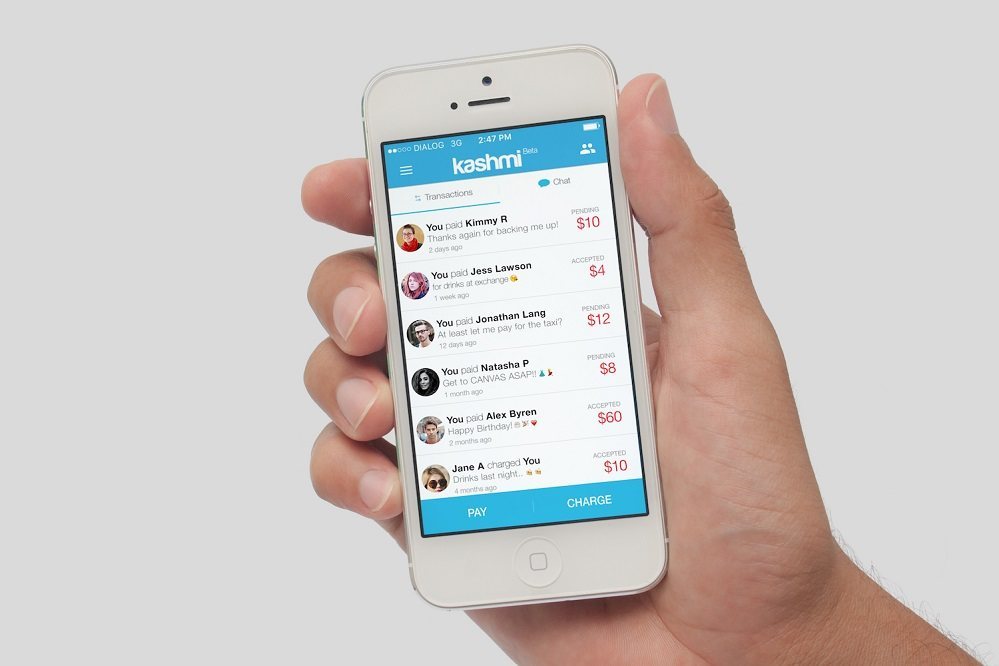

Image credit: Kashmi

Peer-to-peer (P2P) payments startup Kashmi has secured S$700,000 (US$497,000) in seed funding, it announced today.

The startup allows users to send and receive money regardless of which bank they’re using, and to split payments between groups. They can top up their mobile e-wallet using credit and debit cards or even wire transfer, and can sign up to the app with just a name and a phone number or email address. Having soft-launched earlier this year, the app will include social features like chat and a sharing feed, payment tracking, and merchant payments once it’s available next month.

The startup enters a busy space, particularly in Singapore where both startups and larger companies are looking into P2P payments. Fastacash enables payments within apps like WhatsApp and Facebook, and has worked on premier Singapore bank DBS’ mobile payments app Paylah. Singaporean telco SingTel, in collaboration with Standard Chartered, has its own similar offering called Dash. The list goes on.

Kashmi’s team is spread across Sri Lanka and Singapore.

The funding was led by Akbar Group Sri Lanka and VAMM Ventures, a Dubai-based venture capital firm that invests in early and seed stage companies. It was joined by a number of angel investors and corporates from Singapore, Sri Lanka, and Thailand. Kashmi will use the funds to continue working on its product, expand its reach in Southeast Asia, and beef up its sales and marketing resources in order to grow faster.

We have reached out to Kashmi for more information and we will update this story when we hear back.

The startup claims it aimed at a S$600,000 (US$426,000) round, but found it generated enough interest among investors to justify raising more. The seed round will apparently close off at S$750,000 (US$533,000).

This post Social payments startup Kashmi is ready to launch with new seed funding appeared first on Tech in Asia.