WP8 to Bring Marketplace and App Hub to More Countries: Here’s the Asia List

Sri Lanka’s InstaWaves Turns Instagram Hashtags into a Pictorial Story (Sort of)

Harpoen One of Three Asian Startups to Win World Summit Awards

No Amazon Appstore for Indonesia and China – Here’s the Full List for Asia

With 18,000 Restaurants to Be Listed, Zomato’s Next Asia Launch Will be Jakarta (INTERVIEW)

42% of the world’s Internet users live in Asia

India’s Micromax eyes Russia and Eastern Europe as new smartphone markets

Intel Capital has so far invested over $2 billion in Asian startups

The Change School in Bali helps entrepreneurs slow down to speed up

Corsair hosts the first ever Corsair Asia Cup, registrations now open

Corsair is stepping into the Dota 2 eSports scene with the first-ever Corsair Asia Cup. The tournament will feature 12 qualifying teams and the following invited teams:

- MVP (Korea)

- Titan (Malaysia)

- Scythe (Singapore)

- Orange (Malaysia)

- Arrow (Malaysia)

- Mineski (Philippines)

- Zephyr (Korea)

Check out the following tournament poster for qualifier information:

The Corsair Asia Cup will also have the following prizes:

Interested teams may register here.

According to the announcement, the main event of the tournament will be streamed online via the Corsair Asia Cup website. The tournament will also have an in-game ticket. The price has yet to be announced.

This post Corsair hosts the first ever Corsair Asia Cup, registrations now open appeared first on Tech in Asia.

How two Sri Lankans are building a robotic cloud in Switzerland and Japan

The robot from Laputa, the Studio Ghibli island in the sky, and inspiration for Rapyuta’s name.

As the robotics industry gains steam, one question is looming large: how do you make and where do you put robot brains? The hardware of robotics is the obvious challenge, but without the right software a robot is a lifeless hunk of metal. And without an internet connection, even the best software is little more than a definition of the machine’s limits rather than its possibilities. That is why leading tech companies in Japan like Yahoo Japan and SoftBank are creating cloud infrastructure for robotics software. They might be giants, but that has not deterred Rapyuta Robotics, a Japan-Switzerland startup from joining the race.

Dr. Gajamohan Mohanarajah (CEO) and Arudchelvan Krishnamoorthy (COO), two long-time friends from Sri Lanka who studied abroad together at the Tokyo Institute of Technology, co-founded the startup. Rapyuta Robotics – named after the robots featured in a famous Hayao Miyazaki film – aims to create a cloud infrastructure that will allow all robots connected to it to share each others experiences. This reduces the amount of programming that needs to go into the robot initially and means that all connected robots should get progressively more adaptable.

Proving this concept is a heavy challenge. Rapyuta Robotics’ engineering team is developing the robot-based and cloud-based code from scratch. It’s a no-shortcuts approach and it is getting ready to hit the market.

Entering via drones

The first product Rapyuta Robotics is looking to roll out is drones for security and infrastructure inspections. Surveying parking lots and private property is an obvious application of drone technology, but Rapyuta Robotics feels that the infrastructure market is just as promising.

Bridges, tunnels, and other major structures need to be regularly examined. Careful review can be dangerous work, which is why Rapyuta Robotics is programming its drones to carry out the inspections. They fly close to the structure, take pictures, and can access the cloud to compare the current snapshot to previous ones taken in the same location.

Getting pictures taken from the exact same spot, close enough to a large object that one wrong move can impair the drone is too difficult for humans. Rapyuta Robotics’ drones can be programmed to carry everything out autonomously.

That’s also possible indoors. “Everyone flies drones outside because it is easy to get the GPS signals and get the positioning. But, when it comes to indoors, you are not going to get the signal, you need to create a virtual GPS field. Our speciality is that we can create that field for a really cheap price,” Krishnamoorthy explains.

Though drones are the company’s first product, Krishnamoorthy stresses that Rapyuta Robotics is much more. “For now we are focusing on drones, but we are a robot company. Right now we are using flying robots,” he says.

Rapyuta says its technology will make its drones better than out of the box alternatives.

Funding a dream team

Krishnamoorthy is a serial entrepreneur. After earning a master’s degree in financial mathematics from Columbia University and working for Nomura Securities, he co-founded Fund of Tokyo, a global macro hedge fund. Working primarily out of Japan, he is the startup’s business leader.

Dr. Mohanarajah moved to Switzerland after finishing his undergraduate studies in Tokyo. There, he earned a Ph.D. from the Swiss Federal Institute of Technology in Zurich while working on RoboEarth, a pre-cursor of Rapyuta Robotics’ cloud technology. He has also achieved YouTube fame for creating Cubli, a cube that can jump up from a resting position to balance perfectly on one corner.

The rest of the eight-person team is similarly credentialed, with many coming over from the RoboEarth project. The technical side of the startup remains stationed in Switzerland, while Krishnamoorthy works on the business side in Japan.

“You need a really good internet connection to do cloud robotics. Japan and Korea are two of the top countries for internet speed and infrastructure,” he says, explaining why Rapyuta Robotics chose Japan. That’s not to say Europe is entirely forgotten. “In parallel we are going to focus some of the business in Europe, particularly with wind-farm inspections,” he adds.

So far, he’s got the attention of investors. This January, Rapyuta Robotics scored JPY 351 million (US$2.95 million) in seed funding (PDF link) before it could even show off a complete prototype.

The funding came after eight months of bootstrapping the project. Cyberdyne, a Japanese robotics company, led the investment and was joined by SBI Investments, Fuji Creative Corporation, and V-Cube.

With a summer target for having the complete prototype, Krishnamoorthy is on the lookout for more investments. This time he expects the final amount to be “double digit millions” in US dollars.

This post How two Sri Lankans are building a robotic cloud in Switzerland and Japan appeared first on Tech in Asia.

Rocket Internet has a go at job classifieds with launch of Everjobs

Rocket Internet churned out a new startup today with the launch of Everjobs. It’s a jobs classifieds site that launches first in Sri Lanka and Myanmar.

Though the name is new, the site actually stems from Rocket’s own Work.com.mm, the Myanmar-only jobs site that rolled out in June 2012. That gives Everjobs a rolling start in Myanmar. Everjobs co-founder Ronald Schuurs tells Tech in Asia that the Myanmar site – which will retain its old name and URL for the time being – is now getting 150 new job-seekers signing up each day, 140,000 unique visits per month, and it just crossed one million monthly page-views.

Schuurs says that the Myanmar site reached that milestone with mostly organic, word-of-mouth growth, though Rocket Internet is now chasing after new users in the country with online advertisements. He anticipates quicker growth for Everjobs in Sri Lanka thanks to more widespread web usage. “We want to be faster [… and] a bit more ambitious than we were with Myanmar.”

New frontiers

Schuurs says that the Everjobs launch in these two nations fits in with Rocket Internet’s strategy of looking to seize fast growth in what he calls “frontier markets” – places like Myanmar, Pakistan, or Bangladesh where web adoption is growing fast. “They’re a bit more overlooked compared to India or China,” he adds. And so Rocket Internet is looking ahead to the next few years of web growth, aiming to become the dominant player in a nascent market.

Everjobs already has 15 staffers in Myanmar thanks to the early start of Work.com.mm; so far in Sri Lanka it has three local personnel.

Everjobs will expand to more emerging markets in Asia in due course, but the next roll-out will be to an undisclosed nation in Africa in late March or early April.

Berlin-based startup dynamo Rocket Internet now has five startups operating in Myanmar: Carmudi, Lamudi, Kaymu, Everjobs, and Daraz. That last one is an Amazon-like ecommerce store that first started in Pakistan and then ventured into Myanmar late last year.

This post Rocket Internet has a go at job classifieds with launch of Everjobs appeared first on Tech in Asia.

12 international VC firms that have invested in South Asian startups

As smartphone usage booms across Asia and web services become more commonplace, private equity firms and venture capitalists are exploring the lucrative potential of the region. There are a number of global VC firms, especially in Silicon Valley that are keeping an eye on startups on the other side of the planet. Below we’ve identified some big-name VCs who have backed South Asian startups.

1. Morgenthaler Ventures

Morgenthaler Ventures has invested in over 300 companies around the world, including Apple. Since 2008, it has focused a lot more on venture capital investments and thus invested over US$400 million in various business ventures relating to IT and life sciences.

The company showed its confidence in Pakistan-born enterprise chat app Convo and invested US$5 million in it.

2. Sequoia Capital

Sequoia Capital is one of the world’s foremost venture capital firms, started in California in 1972 by Don Valentine, and is currently funding growth-stage companies around the world.

It is well known for having invested in some of the global IT giants of today including Google, Apple, Yahoo, and Amazon. The earliest investment by Sequoia in India was back in 2006 when it put US$20 million in Café Coffee Day over two years. Currently, Sequoia Capital India has as much as US$1.4 billion invested in a number of companies in the nation.

Sequoia has a special preference for technology companies that have India-US cross-border connections. The firm invests in consumer services, healthcare, energy, financial services, and a range of other sectors. Recently, Sequoia announced that it had raised US$530 million in its fourth India focused round of funding which will take its total investment in the country to US$2 billion.

3. ePlanet Capital

ePlanet Capital is a Silicon Valley-based global venture investment firm, with offices around the world. The firm has made more than 100 investments in 14 years and focuses on the sectors of internet services and applications, entertainment, and life sciences.

The firm invested in Pakistan’s Naseeb Networks, maker of a social networking site called Naseeb, and Rozee.pk, an online recruitment website. This Rozee funding is often thought of as the first international investment in a Pakistani web startup.

4. Global Founders Capital

Rocket Internet’s founders teamed up to start Global Founders Capital, which aims to invest seed funds as well as late-stage funding. This venture capital firm started with almost US$180 million and has already invested in a couple of internet businesses. Rocket Internet has focused on investing in lucrative internet businesses in South Asia, the Middle East, South America, and Africa. Its portfolio spans over 50 companies in almost 40 markets.

In Pakistan, Rocket Internet operates fast-growing services like Kaymu and Daraz.

5. Fenox Venture Capital

Fenox Venture Capital is a venture capital firm that is based in Silicon Valley and which has spread its roots globally through investments (disclosure: Fenox Venture Capital is an investor in Tech in Asia. See our ethics page for more information). The company usually focuses on working with emerging tech startups and companies and has assisted enthusiastic entrepreneurs in Asia, Europe, North America and the Middle East.

Fenox recently launched a US$200 million fund for the Bangladeshi IT and media sector. It aims not only to provide early stage funding for Bangladesh’s startups but also promises final round funding and other angel backing.

6. Nexus Venture Partners

Nexus Venture Partners is a Mumbai, India-based VC firm that is considered among the leaders in the local market. It backs growth stage companies either in its home nation or companies in the US that have products and technologies relevant to emerging markets.

Nexus Venture Partners invests in a wide variety of sectors, from technology, cloud storage and big data analytics to media and energy companies. Typically it makes six to eight investments in a year, investing up to US$10 million in early stage companies with a second round of investment based on how successfully a company has implemented its business plan. Nexus was started in December 2006 and currently has a stake in over 50 companies.

It has an estimated US$600 million under management. In 2012, Nexus raised a US$270 million fund to help Indian companies break into global markets as well as to support US-based companies focusing on India.

7. Nasscom

Nasscom is an IT and business-focused trade association in India. It’s not only a local organization but has global connections, with more than 1,200 members and over 250 global companies in collaboration from the US, UK, and Europe.

Nasscom’s member companies run the gamut, across IT products, infrastructure management, R&D services, ecommerce and web services, engineering services, offshoring, animation, and gaming. Therefore, it has made a lot of investments in the tech industry. A while back, Nasscom set up the 10,000 Startups program to bring angel investments, mentorship, and accelerator support. This initiative is being supported by Google, Microsoft, and Intel.

8. Ardent Capital

Ardent Capital was set up by entrepreneurs in Southeast Asia.. It has invested in a range of companies across Asia, including Sri Lanka’s Wow.lk, which has a 80 percent share of the ecommerce market in Sri Lanka. Ardent Capital is a young team, having only started in 2011 and is currently expanding its operations to invest in more early stage technology companies in the region.

9. Frontier Digital Ventures

Frontier Digital Ventures is a Malaysia-based VC that has a prime focus on investing in classifieds and listings businesses. The firm is active in Pakistan where it has invested in Pakwheels and Zameen. Frontier DV invested almost US$3.5 million in Pakwheels; its undisclosed investment in Zameen means it has a significant but non-controlling share in the property listings site.

10. Kima Ventures

Self-styled as the most active angel investors in the world, Kima Ventures has made more than 300 investments in almost 290 companies. This French VC funds with seed capital in promising startups.

Its investment portfolio is quite diverse, in which it has made investments of more than $15 billion. The firm identified the potential in the Pakistan-made, globally-focused Groopic and invested a six-figure sum in the fun photo app.

11. Etohum

Etohum is an Istanbul, Turkey-based startup accelerator program that provides funding to tech startups. The firm has been investing seed money since 2008 and has invested over US$40 million in more than 35 startups and companies.

It spotted and backed the Pakistani app Bookme, a mobile app for booking movie tickets. The accelerator’s crew saw Bookme at the Startup Istanbul event and expressed its willingness to fund the startup.

12. Naspers

South Africa-based Naspers has invested in a lot of companies related to ecommerce, online services, print media, and pay television. More than 80 percent of the strategic investments that Naspers does is in India.

The biggest name Naspers has backed is Flipkart. The homegrown Indian ecommerce giant was initially funded with US$100 million, but it has since raised US$1.75 billion in total. The company has also made significant investments in the popular classifieds site OLX.

For a better international investment ecosystem for the region, it would be highly beneficial if the governments across South Asian nations develop a forum to lure global VCs to the region. With a strategic location, inexpensive labor, a large base of consumers, and quality technical education, tech startups have a lot to contribute to these countries’ economic growth.

A version of this post was first published on Techjuice, a Tech in Asia content partner.

This post 12 international VC firms that have invested in South Asian startups appeared first on Tech in Asia.

Asia’s mobile and broadband internet speeds, in one infographic

How fast is your internet? How much does it frustrate you? Although you likely have a few options for your broadband and mobile data plans, the answers to those questions are largely dictated by which country you’re in.

Data for the latest broadband and cellular speeds across Asia-Pacific reveal that Singapore, Hong Kong, and Japan come out ahead in the home broadband race, but the picture is very different for those out of the house on their smartphones. It’s actually New Zealand, China, and Taiwan that surge ahead in mobile data speeds. The web speed data comes from Ookla’s Net Index, and then we’ve turned all those facts and stats into the infographic you see below.

While Asia beats the global average on broadband speeds, there’s still a huge difference between the haves and the have-nots. Singapore is blazing ahead on an average speed of 118.8 Mbps on broadband, but the Philippines is limping along at 3.6 Mbps. Even worse is that while Singapore’s fixed-line speeds have nearly doubled in the past year, the speed in the Philippines inched up a meager six percent in the past 12 months.

It’s a similar story of woe when it comes to Asia’s cellular speeds. While mobile data in New Zealand and China zooms along at an average of 27.7 and 27.6 Mbps respectively as 4G has caught on in a big way in both nations in the past year, people in Vietnam are staring at blank white pages on their smartphones as data trickles out at just 1.9 Mbps.

Here’s the full infographic:

This post Asia’s mobile and broadband internet speeds, in one infographic appeared first on Tech in Asia.

This Indian VC is looking toward Indonesia for early stage startups

Japanese investors like SoftBank, CyberAgent Ventures, Rebright Partners, and IMJ Investment Partners have established solid footing in Indonesia. So have big Chinese internet firms like Baidu. Even Korea’s Daum Kakao and startup gobbler Yello Mobile have made position plays in Jakarta.

More surprising, however, is the arrival of Indian players. In recent years, direct foreign investment into Indonesia from China and India has increased significantly, despite Forbes calling India the world’s best-performing emerging market last year. One Indian VC fresh off the boat in Indonesia is Mumbai-based Aavishkaar, a compay whose LPs consist entirely of European-based development finance institutions.

In India, Aavishkaar is known for backing nearly 44 startups. Although not limited to the tech sector, some of its notable portfolio companies include a low-cost Indian hospital chain called Vaatsalya and Milk Mantra, a dairy company that sources from smallholder farmers.

Aavishkaar’s Bali-based senior investment manager Adi Sudewa tells Tech in Asia his firm recently locked in US$45 million to start Aavishkaar Frontier Fund (AFF), a pool of money that will focus only on markets outside India. Sudewa is tasked with hunting for early stage startups in four separate markets: Pakistan, Sri Lanka, Bangladesh, and Indonesia.

“We project a total of US$75 million for the fund,” explains Sudewa. “There’s no fixed proportion dedicated for each country, but we expect Indonesia to contribute a significant number of portfolio companies.”

But why Indonesia?

Pakistan makes sense for Aavishkaar, as it likely has a great deal of low-hanging fruit in the form of a large population of more than 182 million, more than 10 percent of whom are already on social media like Facebook. With ecommerce taking off in the country, Rocket Internet has set up shop with its marketplace Daraz (the Pakistani equivalent to Lazada). Daraz’s relative traction has created validation for Pakistan’s ecommerce potential, which has led other company builders to begin eyeing the market.

Bangladesh is another big one, with more than 160 million people, a US$175 billion economy, and a per capita income of US$1,190.

Sri Lanka on the other hand is a smaller market, with a population just more than 20 million and an internet penetration a little over 22 percent. Perhaps AFF sees Sri Lanka as a petri dish which can potentially birth startups that will go regional.

Indonesia represents a large opportunity for any startup investor, but culturally and geographically speaking, the archipelago is not terribly similar to India. Sri Lanka, Pakistan, and Bangladesh on the other hand, all directly border the second-largest Asian nation. This arguably makes them more familiar territories for an Indian VC like Aavishkaar. In that respect, a move into Indonesia doesn’t seem to make a whole lot of sense for the foreign firm, despite its inherent market potential.

Hunting for immaturity

Regardless, Sudewa says AFF has a keen eye on tech innovation, but is specifically looking for seed and series A startups in agriculture, healthcare, education, water and sanitation, renewable energy, and more. “Technology for development is an area that is very interesting,” he adds. “If there are fintech, edtech, or healthtech companies […] that aim to solve social and economic issues of people in the lower-income segment, those could be good fits for our fund.”

In India, early stage investment is already big and relatively mature industry. Hence there are a range of startups which focus on Indian and international opportunities. It’s not uncommon to see low-cost hospital chains, solar companies, microfinance, or drip irrigation companies receiving series B, series C investments, or even going to IPOs. Here [in Indonesia], the industry is not in that stage yet, although we believe the potential of Indonesian startups is huge, and that’s why we are here.

Sizing up the archipelago

In Indonesia, Sudewa sees healthcare as a challenge Aavishkaar can address. According to him, healthcare is challenging because most local operators are still adjusting to the government’s new universal insurance scheme. In this respect, Sudewa is likely already speaking with firms like MeetDoctor, UDoctor, and KlikDokter.

However, he’s not shy about revealing the startups AFF is already keeping tabs on. He adds:

There are many Indonesian startups that we like. I personally like e-Fishery a lot, as both its commercial and impact potential are promising. The team is also fantastic. They have achieved so many things and won so many awards but are still humble and keeping open mind to new ideas. We would love to see more young Indonesians following their path.

AFF has been officially active in its key target markets since earlier this month. The firm doesn’t have a quota for investments in the archipelago, and currently, Sudewa is the only one on the ground in Indonesia on behalf of AFF. However, according to him, he has two partners stationed in Mumbai, who fly in regularly to help prospect for interesting companies.

This post This Indian VC is looking toward Indonesia for early stage startups appeared first on Tech in Asia.

Their startup survived a tsunami and Sri Lanka’s fledgling internet. Now it’s booming

It was in the early 2000s when a group of five young, ambitious high school graduates from Sri Lanka realized their burning desire to strike out on their own. They were enthusiastic about entrepreneurship and yearned to make it big – building a company synonymous with quality and excellence.

Despite barely being out of their teens, the five friends proceeded to register and launch their company, Vesess. They called themselves “The 5,” and their company logo was five fingers and a palm. Initially they dabbled in several fields, trying to test the waters and see what would stick. One of their early products was a Flash-based Valentine’s card, which they hoped would appeal to the younger generation of Sri Lankans.

The biggest stumbling block the entrepreneurs faced was that not many people in Sri Lanka used the internet. They understood this was the future and it made sense to invest their time and resources in building a tech company, but there was very little traction on the ground. Furthermore, attitudes towards entrepreneurship were not as widely-ingrained – bigger companies felt uncomfortable working with startups as they felt they didn’t have enough experience and exposure to be reliable partners.

Reality hit hard when they tried to market their proprietary financial application, called Investor. It was aimed at facilitating the transition from traditional stock brokerage processes to digital. People wanted applications to monitor trends and analyze data, so theoretically the product should have taken off. Unfortunately, prospective clients were not convinced of the company’s viability and the idea tanked.

Verge of collapse

Prabath Sirisena

Vesess faced an uncertain future. Some tough decisions needed to be made to ensure the firm stayed liquid and didn’t collapse. Cash flow issues meant they weren’t able to afford extravagant salaries and three of the original founders parted ways with the company, concentrating on their individual careers instead. The two who chose to stick it out were Lankitha Wimalarathna and Prabath Sirisena – currently the CEO and creative director of Vesess respectively.

Lankitha Wimalarathna

“We wanted to do something really beautiful – like Virgin. Build a brand which can be extended into any vertical […] We tried utilizing our skills in print design and web development but it was difficult and we almost collapsed,” explains Lankitha.

In 2004, Sri Lanka was hit by the huge Indian Ocean tsunami that brought death and widespread devastation. The entrepreneurs wanted to help their country recover from the disaster and Prabath had an idea to design a site which would assist in transmitting information. Within 24 hours, the duo had a small web page ready, which provided contact information for all humanitarian organizations and government agencies working on the ground for disaster relief. Their site quickly became the sole point of reference for anyone interested in assisting Sri Lanka recover from the disaster.

“We started getting responses and inquiries from everywhere in the world, particularly Western countries,” explains Prabath. “Anyone who wanted to help got in touch with us and that was the turning point for Vesess.”

Social good led to opportunity

Soon after the tsunami, Vesess landed its first international project – designing web pages for a British company. They were able to do a good job, and with word of mouth, the number of projects started to increase rapidly. Prabath explains they were active in forums and discussion groups across the internet and positioned themselves as a “standards-compliant” web design firm. This, he claims, helped Vesess immensely as they were able to build credibility.

But as Vesess scaled up, both Prabath and Lankitha started to understand other pain points. One major problem was the lack of an effective and smooth online payments gateway. As a Sri Lankan company, its international clients had to route payments through traditional mechanisms like banks. This meant heavy transaction costs, often about 10 percent of the total billed amount – a figure most clients were unwilling to pay. Fintech solutions like PayPal didn’t work in the country and the entrepreneurs knew this was a problem faced by many more.

“We went to local banks to find a solution but the situation was really bad. We were a young company and they were hesitant to give facilities to us. But we had the courage to look forward. We incorporated our company in the US and built a mechanism to facilitate payments,” recalls Lankitha.

What they came up with was Hiveage (previously Curtbee), an online billing, invoicing, and payments tool targeted at freelancers, “solopreneurs”, and small businesses. As they had the foresight to register their company in the US, they were able to integrate PayPal for a seamless experience.

In 2009 their product was featured on Lifehacker and yet again Vesess was propelled into the limelight. They got thousands of signups and inquiries from more payment providers. Finally banks were also interested in collaborating with them and were belatedly given permission to build their own SaaS model. Today, Hiveage serves 45,000 businesses in 140 different countries.

Constant innovation

Despite a steady stream of success, the entrepreneurs weren’t content just to sit back. Vesess’ new service, launched in September this year, is called Vgo – a cloud-based SaaS logistics technology platform that’s trying to help traditional taxi and logistics companies compete with disruptors such as Uber.

“We’ve always had the objective of going into enterprise SaaS and met with players in the logistics and transportation industry who were looking at the same lines […] Vgo provides necessary tools from dispatch to mobile applications as well as call center technologies so that companies can focus on their core business,” explains Lankitha.

Vgo started with seed funding of US$1 million, with Vesess one of a total of four investors who participated in the round. It’s already managed to snare several paying enterprise customers and Lankitha says they’re in discussion with many more. “The rate at which it has grown is great.”

The days of solely providing consultancy services are almost at a standstill – Lankitha says they’re very selective when it comes to projects now and prefer to concentrate on their proprietary solutions instead. Vesess currently employs a team of 15 people but they’re scaling aggressively as they see strong potential for Vgo. “In 5 years we want to become a platform-as-a-service company. We’re looking to expand our fleet and operations beyond the Sri Lankan context and also enter into an IPO in the near future.”

This post Their startup survived a tsunami and Sri Lanka’s fledgling internet. Now it’s booming appeared first on Tech in Asia.

6 years after a bloody civil war, Sri Lanka bets on startups, attracts investors

Sigiriya, Sri Lanka

When you visit Sri Lanka, it’s hard to imagine that the beautiful, teardrop-shaped island was once the ground of one of the bloodiest civil wars in history. Two ethnic groups – the majority Sinhalese and the minority Tamil – were engaged in a bitter war that claimed the lives of an estimated 100,000 people in thirty years.

Since the war ended in 2009, however, the country has seen massive change. Sri Lanka is now ranked 73rd in the world on the Human Development Index, higher than India at 135 and China at 91. Among the people of the island, this change has manifested itself in many different ways.

“I studied political science and did my masters in international relations,” says Lahiru Pathmalal, co-founder of Takas.lk, one of Sri Lanka’s largest ecommerce sites. Although Lahiru worked with NGOs and different conflict resolution organizations, he did not feel the dynamism necessary to change the face of the country. “It was all government work all over again,” he explains.

Takas.lk was founded in 2012 by Lahiru, Dilendra Wimalasekere, and Murtaza Moosajee. Its latest round of funding was US$500,000 led by local investors. Other competition in the sector includes Wow.lk, an ecommerce site that recently entered the ticketing space for Sri Lanka’s cricket team and expanded its site to read in Tamil, Sinhala, and English. Ikman.lk is a popular classifieds site that connects sellers and buyers all over Sri Lanka. Despite the growing presence of ecommerce, however, it is still in its very early stages.

“Our most difficult challenge has been raising money,” Lahiru says. “It’s hard to show a proof of concept. How do you explain to people that ecommerce is here to stay? It is changing ever so slowly, but people are still critical of the entire framework of the country.”

While it’s not always easy to compare countries – especially two that are so vastly different in size, geography, and climate – Sri Lanka and India do have a lot of similarities. “We’ve implemented a few similar techniques for our buyers,” explains Lahiru. “We were the first site to offer cash on delivery services here, as well as tie-up with certain banks to allow people to pay directly from their accounts.”

A large part of Sri Lanka’s population is already online. “We have 5 million out of 20 million people on the internet,” says Lahiru. “There are 4G colonies across the country and Google’s balloon project promises to get internet to every corner of the country in the next few years.”

Most products sold on the site are electronics goods and the concept of inventory stocking is still novel to Sri Lankan ecommerce. “We stock with the guarantee that we will sell our products within three days,” explains Lahiru. “We ship our things out immediately.” After a product reaches their site in the island’s capital, Colombo, Takas.lk’s internal logistics team handles the rest. “The only part we’ve outsourced is the last mile,” says Lahiru.

Investment in Sri Lanka is increasing

Colombo, the capital city of Sri Lanka

Despite Lahiru’s difficulties in raising money, the interest in Sri Lanka is starting to rise. Asia’s biggest economies have been looking at the island as a possibility. Its largest trading partners are India and China, in that order. The Chinese government was lending up to US$490 million to the country in 2012, with a 50-fold increase in the past decade.

When I spoke to Prajeeth Balasubramaniam, founder of the Lankan Angel Network and an investor in Takas.lk, he had just finished something that he called an “empowerment program hackathon.”

“We hold entrepreneurship programs around the country,” he said. “This one was in northern Sri Lanka, where much of the war happened. 80 percent of the startups were tech-related, and each year we fund one to two entrepreneurs. After that, we put them into an incubation and mentoring program.”

The Lankan Angel Network is an alliance of angel investors with 75 members, including the vice president of Google Southeast Asia and India, Rajan Anandan, and the president of the Indian Angel Network, Padmaja Ruparel. They’ve also funded companies like the Lanka BPO Academy, a higher education training academy in the IT and BPO (business process outsourcing) services, and Nithyarn, an online store for hand-woven, traditionally inspired products.

For Prajeeth, his investments are not focused on creating lifelong entrepreneurs. “We select entrepreneurs with the idea that they will be doing something else in five years,” he explains. “The ecosystem here is very young and we’re trying to make it grow. We have a finance team inside our incubation center that helps them project how to financially leave their company.”

The worst fear of an entrepreneur in an early ecosystem, Prajeeth says, is that the hard work people put into their ideas might be worthless when they are stolen and replicated. “It sounds ridiculous, but in the early stages of a startup ecosystem these things happen,” he says. “We’re trying to build trust. We’ve started the Venture Engine, an initiative where startups can find interested angel investors. It’s all about building an ecosystem where people can feel safe.”

What else can Sri Lanka do to promote its startup ecosystem?

This post 6 years after a bloody civil war, Sri Lanka bets on startups, attracts investors appeared first on Tech in Asia.

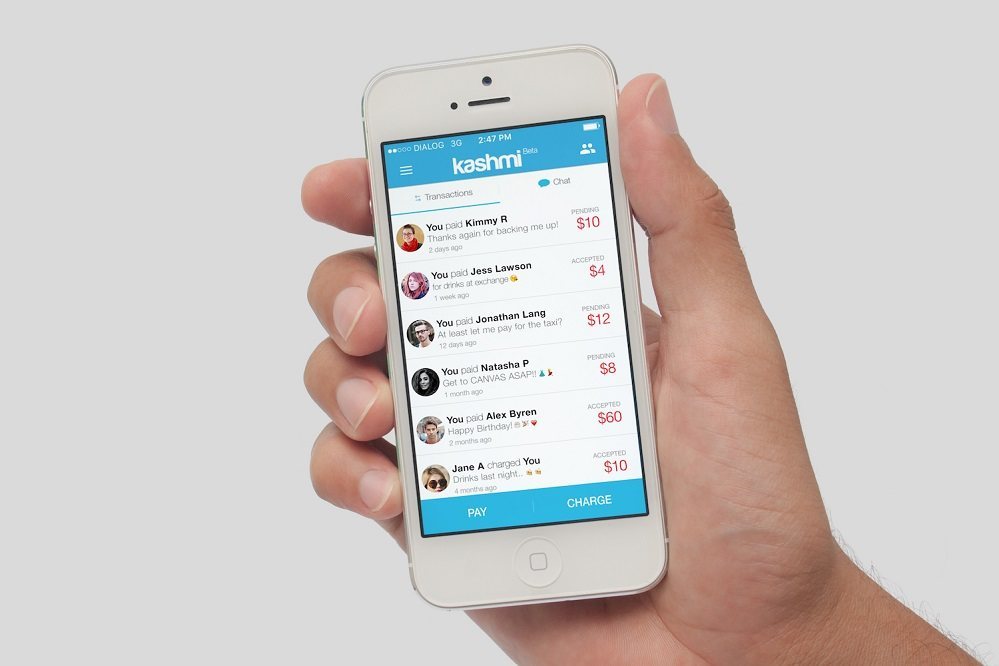

Social payments startup Kashmi is ready to launch with new seed funding

Image credit: Kashmi

Peer-to-peer (P2P) payments startup Kashmi has secured S$700,000 (US$497,000) in seed funding, it announced today.

The startup allows users to send and receive money regardless of which bank they’re using, and to split payments between groups. They can top up their mobile e-wallet using credit and debit cards or even wire transfer, and can sign up to the app with just a name and a phone number or email address. Having soft-launched earlier this year, the app will include social features like chat and a sharing feed, payment tracking, and merchant payments once it’s available next month.

The startup enters a busy space, particularly in Singapore where both startups and larger companies are looking into P2P payments. Fastacash enables payments within apps like WhatsApp and Facebook, and has worked on premier Singapore bank DBS’ mobile payments app Paylah. Singaporean telco SingTel, in collaboration with Standard Chartered, has its own similar offering called Dash. The list goes on.

Kashmi’s team is spread across Sri Lanka and Singapore.

The funding was led by Akbar Group Sri Lanka and VAMM Ventures, a Dubai-based venture capital firm that invests in early and seed stage companies. It was joined by a number of angel investors and corporates from Singapore, Sri Lanka, and Thailand. Kashmi will use the funds to continue working on its product, expand its reach in Southeast Asia, and beef up its sales and marketing resources in order to grow faster.

We have reached out to Kashmi for more information and we will update this story when we hear back.

The startup claims it aimed at a S$600,000 (US$426,000) round, but found it generated enough interest among investors to justify raising more. The seed round will apparently close off at S$750,000 (US$533,000).

This post Social payments startup Kashmi is ready to launch with new seed funding appeared first on Tech in Asia.

Why investing in Sri Lanka is like turning the clock back for Google India chief

Rocket Internet’s property portal Lamudi raises $31.4m from existing backers

500 Startups launches $25m fund for India, Sri Lanka, Bangladesh

Rocket Internet’s ‘Uber for budget hotels’ launches in Singapore and 3 more Asian nations

Rocket Internet merges ecommerce sites Daraz and Kaymu across Asia

Google Southeast Asia & India head, others launch VC fund for Sri Lankan startups

Sri Lanka isn’t synonymous with world class tech. But that might be about to change.

Here’s what Jack Ma should buy next

Photo modified by Tech in Asia; original photo credit: UN Climate Change.

Ever since Jack Ma’s Alibaba took control of Lazada in a US$1 billion deal last year, there’s been speculation about what the ecommerce titan might do next.

I think the natural choice is Daraz, an online store for Pakistan, Bangladesh, Myanmar, and Sri Lanka, which encompasses a combined market worth US$610 billion. Like Lazada, Daraz is born out of the Rocket Internet empire.

So far the Chinese billionaire has played his cards close to his chest about what comes after the Lazada deal for Southeast Asia. He’s preferring to impart “ecommerce training” to thousands of small businesses spread across Lazada’s six countries.

He’s also reportedly excited at the prospect of sharing knowledge with Lazada’s management, which fits in with his wider vision of using Alibaba to sell directly to consumers – slashing costs and eliminating the cut any shady middlemen might be pocketing.

But that’s easier said than done. Trade across much of Asia is riddled with bottlenecks such as potholed roads, decrepit railways, inefficient logistics, and quirky customs processes. If Alibaba and its Taobao and Tmall marketplaces are really to act as the engine for consumer purchases in this region, then they’ll need to figure out a lasting solution.

And it’s not like Jack Ma doesn’t want to expand his business. Ant Financial, his mobile wallet app, has made investments in India, Thailand, South Korea, and the Philippines. It also bought US-based remittance company Moneygram for a cool US$880 million.

Anecdotal evidence seems to suggest that Ma wants to make it extremely easy for consumers to have access to millions of products and pay for them via their phones. And while he’s not completely there yet, the broader vision is to muscle out Amazon without the need to physically enter markets from scratch.

So what’s the next step?

Here’s how acquiring Daraz fits in.

First, Chinese companies aren’t averse to following their government’s lead. McKinsey notes that “government policy continues to be the critical shaping force” of the economy, with the state “possessing levers” to dictate the pace of economic growth.

The government’s pivot to Africa is now several years old. Large Chinese firms specializing in energy, construction, and logistics signed a mammoth US$70 billion worth of contracts in Africa in 2014 alone. Followed closely by this was phone maker and telecommunications firm Huawei, which set up a training school in Nigeria in an effort to hone the skills of engineers and strengthen cellphone networks across the continent.

The Chinese want to bypass the congested Straits of Malacca.

But now China’s embarking on a much more ambitious project through which it wants to establish itself as the central hub of global trade. Dubbed “One Belt, One Road”, the project aims to build road and railway links from Chinese industrial hubs to European capitals via Central and South Asia. It’s like a new Silk Road.

Overall, the project, first announced by President Xi Jinping in 2013, will span approximately 65 countries that account for one-third of the world’s GDP and about a quarter of all the goods and services consumed. The Chinese have committed to spend hundreds of billions of dollars to make this a reality, and work is moving forward rapidly.

An important part of this new Silk Road is Chinese investment in Pakistan, Bangladesh, Myanmar, and Sri Lanka. In Pakistan, the Chinese government has committed to spending north of US$50 billion in improving logistics, power generation, communication links, hospitals, and schools. The cornerstone of their effort is access to a deep water port in the southwestern city of Gwadar.

The port, already operational, gives China access to shipping lanes in the Indian Ocean – bypassing their traditional routes via the Straits of Malacca and the South China Sea. The move is important both for strategic and business reasons – shipping corridors in the densely-populated Straits of Malacca are closely watched by the US Navy and the Chinese are desperate to open up alternatives.

The proposed maritime Silk Road. Photo credit: Mantraya.

In Sri Lanka, the Chinese have already built Hambantota port near Colombo to further integrate logistics and secure shipping lanes. Bangladesh formally joined the Belt and Road Initiative in October, after President Xi visited Dhaka to sign a number of agreements in energy, industrial capacity, information technology, and maritime cooperation.

Part of the reason the Chinese government wants to step ahead with this program is access to new markets and utilization of excess domestic industrial capacity. For China to move away from an export-oriented economy towards a service and consumption-oriented one, similar to that of the US, it’ll need access to cheaper labor and modes of production.

Nowhere is that dynamic more prevalent than the frontier markets of Asia.

Where does Jack Ma fit in?

Part of the reason for Alibaba’s success has been the fact that entire Chinese villages have jumped onto the ecommerce bandwagon, helping them escape poverty by selling everything from electronics to toys.

In 2013, Taobao was the 12th most visited site on the internet and sold US$145 billion worth of goods, dwarfing Amazon’s US$88 billion. Sales on Alibaba’s marketplaces rose to US$430 billion in 2015; no comparable Amazon data is available.

China’s ecommerce market is huge, yet it only accounts for 11 percent of total retail sales which means it won’t stagnate anytime soon. But there’s also a tantalizing opportunity to sell goods to the globe – and the new Silk Road initiative means this is more of a reality than ever before.

Lurking in these frontier markets of Pakistan, Bangladesh, Myanmar, and Sri Lanka is Daraz. Alibaba officially doesn’t have a presence in these countries yet – they’re serviced by AliExpress, but that’s about it. But Daraz isn’t letting that prevent it from sourcing Chinese products to sell on its marketplace.

Bjarke Mikkelsen, CEO of Daraz Group, refutes rumors swirling in Pakistan’s tech industry of Alibaba’s interest in acquiring the company, but admits to Tech in Asia they’re “constantly in touch with friends in Lazada.” He’s also spending more and more of his time in China to figure out what products would appeal to local consumers in his markets.

Daraz also recently hired Zain Suharwardy, previously a senior Lazada VP based out of Malaysia, to look after its operations in Pakistan. Bjarke hinted that the move gives him breathing space and the bandwidth to step away from day-to-day operational decisions to concentrate on overall strategy and growth.

Germany-based Rocket Internet made Daraz into one brand across its four nations after the acquisition of Lazada. Did the Samwers foresee a scenario where its smaller ecommerce arm would also come onto Alibaba’s radar? Don’t bet against it.

Another hint of Alibaba’s widening net came in January when Jack Ma met Nawaz Sharif, Pakistan’s Prime Minister, on the sidelines of the World Economic Forum in Davos.

During the meeting, Ma reaffirmed his desire to help small businesses in developing countries and added that executives from his firm were closely monitoring progress in Pakistan’s ecommerce space.

He even declared they’re ready to make a firm investment in the country, which traditionally has been very closely aligned with China.

Jack Ma (right) meets Nawaz Sharif (left) on the sidelines of Davos. Photo credit: Twitter.

Can the deal happen?

Buying Daraz Group would be chump change for the likes of Alibaba. Unlike Lazada, which raised hundreds of millions of dollars from investors such as Temasek, Daraz has publicly announced only one investment round so far – US$55 million from UK’s CDC Group.

If Jack Ma does decide to buy Daraz, it’s likely the value of the transaction would probably be in the range of US$100 to $150 million. That’s a far cry from the US$1 billion for Lazada.

Daraz could be a significant coup for the self-made billionaire. With one swipe of his pen, he would have access to markets that are firmly on the priority list of his government. That’s a good way to maintain close ties with Chinese bureaucrats – and it makes business sense too.

Pakistan, Bangladesh, Sri Lanka, and Myanmar have a combined population of about 450 million – that’s larger than Lazada’s markets. They’re also rapidly growing economies, part of what Barrons calls the “quiet rise of South Asia”.

The opportunity for Alibaba to upsell its products and take advantage of the Chinese government’s fervent desire to improve transport linkages is very real. At the same time, Chinese shoppers can benefit from a wider variety of goods manufactured in countries along the new continental industrial belt.

As China accelerates its shift towards a consumption-driven economy, demand for such goods is likely to pick up. Alibaba would be poised to grab that share too.

China’s total trade with the countries along the One Belt, One Road initiative exceeded US$1 trillion in 2015. It would be foolish to think that Jack Ma doesn’t already have his eyes on a slice of that pie.

This is an opinion piece.

This post Here’s what Jack Ma should buy next appeared first on Tech in Asia.

With $4m new funding, Rocket Internet’s Zen Rooms sets its sights on more markets

Photo credit: Zen Rooms.

Zen Rooms, Rocket Internet’s hotel booking platform for cost-conscious travelers, today announced it raised US$4.1 million in series A funding from Redbadge Pacific and SBI Investment Korea. Existing investor Asia Pacific Internet Group, founded by Rocket and Qatari telecoms provider Ooredoo, also participated.

The round brings the startup’s total funding to date to US$8 million and will fuel its expansion across Asia.

Travel is immensely popular in the region but consumers face difficulties in discovering tidy hotels at reasonable rates. The practice is to use Agoda or Booking.com, but many small hotels are not on those platforms. If they are, they get crowded out by the ones with the ability to pay for higher ranking in the results.

Like other Rocket companies, Zen Rooms takes after a proven business concept – India-based Oyo Rooms. It partners with budget hotels to build a network of rooms that it spruces up to provide a standardized service. In exchange, it takes a commission out of each successful booking.

Customers can expect, at the very least, six things: a clean room, comfortable bed, in-room shower, flat-screen TV, air conditioning, and wifi – for as low as US$10 per night. The company says its rates are 30 to 40 percent cheaper than traditional budget hotel chains.

Co-founder Kiren Tanna declines to give detailed information on how the company’s performing, except to say that “our unit economics are healthy, which is why both new and existing investors are investing.”

“Our average order is US$85 which is comparable to ecommerce, but we don’t incur any delivery related costs,” he adds.

From its launch in 2015 to date, Kiren says the company has generated tens of millions of dollars of bookings for its partners. “In 2016, we grew 20 times in booking volume and this year we are projected to grow five to eight times.”

Staying ahead

Zen Rooms is working with more than 1,000 properties in the eight markets where it has a footprint: Indonesia, Thailand, Singapore, Hong Kong, Philippines, Malaysia, Sri Lanka, and Brazil. Indonesia, where the company first launched, is its biggest market.

“While these are our focus markets, we are also considering expansion to Australia and New Zealand, North Asia, and Vietnam,” notes Kiren.

Kiren Tanna. Photo credit: Zen Rooms.

It won’t be completely smooth sailing for the Rocket-backed startup though. The market has heated up as more entrepreneurs grasp the potential this niche promises. Tinggal in Indonesia has funding and support from India-based Wudstay. There’s also another Indonesian player called Nida Rooms, which got injected with fresh cash after experiencing financial troubles late last year. Zen Rooms also faces competition from Singapore-headquartered RedDoorz and predecessor Oyo, if the latter decides to expand beyond India.

Nonetheless, Kiren is confident his team will be able to stand out by focusing on innovation. “Our DNA is to pilot new disruptive features that make customer experience great.”

With the new funds, Zen Rooms will further scale its recently rolled out features such as pay-at-hotel, which is a 100 percent card-free booking. “This is a key move to further democratize travel in a context where the majority of the Southeast Asian population is unbanked today. After piloting it with great results, we are currently deploying the option across our franchise base. We are very confident it will do to the hotel sector what cash-on-delivery did to ecommerce adoption.”

Zen Rooms also has self-check-in kiosks and locks. In addition, it’s working on a new version of its mobile app to make the whole process – from booking to checkout – seamless.

This post With $4m new funding, Rocket Internet’s Zen Rooms sets its sights on more markets appeared first on Tech in Asia.

You can score a $1m seed round even in Sri Lanka. These founders show how.

ODoc founders Heshan Fernando, Sohan Dharmaraja, Dr. Janaka Wickremesinghe, and Inshard Naizer. Photo credit: oDoc.

The island nation south of India with its gorgeous beaches, rainforests, and ancient Buddhist ruins just saw one of its startups – medtech app oDoc – score US$1 million seed funding.

This is the largest seed investment round for any startup in Sri Lanka.

The country’s startup ecosystem is still very young with over 50 percent of its entrepreneurs using their personal savings to fund their companies. The seed funding round for oDoc comes at an opportune time as the island’s mass market is embracing tech through new ride-hailing options.

ODoc isn’t going after the mass market though – at least not yet. The app connects patients with doctors for video consultation. Say you wake up in the morning with a nasty rash and fever. Three taps on your smartphone and you can submit your pre-consultation notes, take a picture of your rash, and get a doctor to review those. A doctor will call you and send his prescription with the doctor’s seal and signature right to your phone. All done in 10 minutes.

Many startups around the world have been at it but oDoc’s four founders – with their diverse backgrounds – approached it more from a design perspective than as a tech problem to solve.

“The reason nobody has really cracked it is because they looked at it as a medical problem. They were building it as an Uber for doctors of sorts. But it is really about changing behavior. So it is more of a design problem. It needed a fresh set of eyes,” the founders tell Tech in Asia.

Stalking investors

The credentials of the founders plays a key role in instilling investor confidence, especially in the early stage of a startup when the product usage is yet to take off. That’s true for oDoc as well.

Before turning entrepreneur, oDoc CEO Heshan Fernando was the youngest assistant vice president of Sri Lanka’s largest listed company John Keells Holdings. He holds four majors – in mathematics, statistics, economics, and operations research – from the University of Warwick.

ODoc’s tech head Sohan Dharmaraja – with a PhD in computational applied mathematics from Stanford and masters from MIT – was an algorithmic trader with Goldman Sachs. He had built a braille keyboard app for the blind when was in the US.

Dharmaraja came back to Sri Lanka after his PhD. He tells Tech in Asia that he didn’t want to be just another expat critiquing his home country from afar instead of trying to push change himself.

Back home in Lanka, he started marketing tech startup SocialRoo with data analytics before moving to a consulting business. But he found it tough to convince companies in Sri Lanka what data analytics could do for their business.

Dharmaraja finally found his metier in oDoc, which has two more co-founders: Inshard Naizer, Fernando’s former colleague from John Keells, and Dr. Janaka Wickremesinghe, a general physician who holds three patents. Dr. Wickremesinghe is also the founder of Sri Lanka’s first online medical education platform CorpusMedici – which a third of all doctors in the island nation subscribe to, according to Fernando.

The investors who pumped in the US$1 million are Ajit Gunewardene, deputy chairman of John Keells; Phoenix Ventures, the investment arm of Sri Lankan apparel exporter Brandix; and Loits, the IT arm of conglomerate Lolc.

The oDoc team started the fundraising efforts early this year.

Gunewardene has known Fernando for nine years now, and he was also one of their mentors. “Even with him we walked a very fine line between being persistent and getting a restraining order,” Fernando jokes. “We assumed it would take us three months, but kept a six-month timeline. It ended up taking nine months,” he tells me.

Gunewardene’s endorsement piqued the interest of the other two investors, and finally, the team clinched the deal last week. The money has hit oDoc’s bank account and the team is going to hire more hands and start marketing their product now.

See: 6 years after a bloody civil war, Sri Lanka bets on startups, attracts investors

Photo credit: oDoc.

AI to help doctors diagnose better

The founders spent 12 months designing and building oDoc, which they describe as a “360 degree solution” – providing pre-consultation notes, video calls, and the prescription sent to your smartphone.

They began by building an electronic medical record system that would allow a doctor to document a consultation digitally. “We believe that there is a lot of power and insights that can be gathered from the consultation data which will be passing through our system. We want to collect, store, and analyse that data to provide insights to the doctors, and eventually move into a point where some of the consultation can be automated using AI,” Dharmaraja says.

Tap a button and you can consult a doctor anonymously too but then you won’t get a prescription.

For example, the AI could assist the doctor in diagnosis by reading the patient’s complaints or if the doctor is prescribing a medicine, the system can suggest the right dosage automatically.

“There were nuances in this space that had to be built into the product. Trust between the doctor and the patient, for example. You don’t need to be convinced of the skills of a driver when you are trying to book a cab. But patients will always have a concern about how good a doctor is. We built the app taking such nuances into consideration,” Dharmaraja says.

Patients will be charged a consultation fee, of which oDoc will get a percentage. The startup is mulling a subscription model as well, Fernando adds.

The oDoc app is available in three languages – English, Sinhalese, and Tamil. Its immediate goal is to get product-market fit. In the next five months, they’re aiming for 1,000 successful consultations – where doctor and patient are happy with the experience.

But there are inherent challenges. For instance, although a little over one-third of Sri Lanka’s 20 million people have smartphones, only around four million use the internet. There is 3G coverage in 75 percent of the country, and the big cities have 4G as well.

To begin with, oDoc requires a mindset shift in the users who have to get familiar with the idea of video consultation as an effective form of medical care delivery. “People have doubts like “Is this prescription really valid? Can I go to a pharmacy and show this to them?” Legally, there is nothing wrong with it but not many people know that,” Fernando says.

See: Sri Lanka isn’t synonymous with world class tech. But that might be about to change.

Colombo, Sri Lanka. Photo credit: Andrew Fysh.

Can convenience beat fear?

Telemedicine has been breaking down geographical barriers and bringing access to medical care to remote parts of the world. For years, radiologists in India have been consulting with hospitals in Africa using digital technology. But when it comes to conditions that need immediate attention, even if they are minor, video consultation has not caught on in India or Southeast Asia yet.

To begin with, oDoc requires a mindset shift in the users.

The convenience factor could do the trick though. For example, an app like oDoc could reduce leg work for chronic patients who go to a doctor every month to show a blood report. They could just click a picture of the report and talk to the doctor about it from anywhere.

For patients with mental or sexual health problems, who are hesitant to go to a hospital due to fear of stigma, consulting a doctor anonymously on oDoc is an option. “Tap a button and you can do it on an anonymous mode too but then you won’t get a prescription. The system will not collect or store any of your details either,” Dharmaraja explains.

Currently, the doctor-patient ratio in Sri lanka is 1:1000 – quite similar to India. ODoc has roped in 25 doctors in Colombo, Kandy, and other main cities of the country.

“For a product like oDoc, the easiest way to get more users is when they are at a doctor’s clinic or at a pharmacy. We could get doctors to tell their patients to do the follow-up consultation over oDoc – as a tool of convenience as well as to save their time,” says co-founder Inshard Naizer, who is also oDoc’s chief growth officer.

They are initially going after patients in Colombo. “Then to all other cities of the country, and then other Commonwealth countries. Bangladesh and Maldives, for example, where geography is a barrier and medical care could be improved,” Naizer says.

The nascent Sri Lankan startup ecosystem would get a boost if startups like oDoc gain traction and catch the attention of investors from abroad. The Lankan government’s Information and Communication Technology Agency has been holding an annual Disrupt Asia conference since last year to showcase what the island nation has to offer in tech innovation. But, as the saying goes, nothing succeeds like success on the ground.

Want to learn more about fundraising and how you can raise funding for your startup? Register your interest here so we can tailor content that you’d want more of at our Tech in Asia conferences!

This post You can score a $1m seed round even in Sri Lanka. These founders show how. appeared first on Tech in Asia.

Alibaba grows empire yet again with South Asia acquisition

Alibaba founder Jack Ma / Photo credit: Alibaba

China’s online shopping giant Alibaba grew its fledgling worldwide empire today with yet another fresh acquisition.

Alibaba is now the owner of Daraz, an online marketplace startup that covers Pakistan, Bangladesh, Sri Lanka, Myanmar, and Nepal. This afternoon’s joint announcement doesn’t reveal any financial details.

The move comes just over two years after Alibaba expanded into Southeast Asia by buying the region’s top online shopping destination, Lazada. The Chinese firm also runs Singapore’s Redmart, and owns stakes in India’s Paytm and Indonesia’s Tokopedia.

Rocket start

Just like Lazada, Daraz began life as part of Germany’s startup factory, Rocket Internet, which specializes in opening businesses in developing markets. It launched in 2012, initially focusing on Pakistan – arguably the largest relatively untapped market in Asia, with a population just over 200 million.

A model at Pakistan Fashion Week / Photo credit: Farrukh

Daraz’s five markets cover 460 million people, 60 percent of whom are under the age of 35. Although online shopping accounts for a tiny amount of the overall retail market in those nations, each one is poised for growth as more people come online. Pakistan’s online shopping spend is set to grow from the roughly US$100 million mark seen in fiscal year 2015-16 to more than US$1 billion in 2017-18, according to pundits.

“Pakistan is one of the last remaining ecommerce markets which offers large unfulfilled potential,” says Osman Husain, a tech analyst. Last year, when Husain was my colleague at Tech in Asia, he wrote that Daraz is what Alibaba founder Jack Ma should buy next in the billionaire’s increasingly global spending spree.

“Alibaba’s acquisition of Daraz is a vote of confidence in South Asia; China’s One Belt, One Road (OBOR) project impacts all markets where Daraz is present and it’s likely that small businesses across Asia will benefit from this move. It’s a bit sad to see Rocket Internet exit Asia, but there’s no doubt exciting times ahead,” adds Husain.

Jack Ma last year visited Pakistan and met with Prime Minister Nawaz Sharif amid a buzz of rumors about the company making moves into the nation.

Alibaba’s payments wing, Ant Financial, entered Pakistan in March by taking a 45 percent stake in Telenor Microfinance Bank, maker of the popular online banking service Easypaisa.

Updated 6:40pm: Swapped in a more recent projection for Pakistan’s online shopping market, replacing the original “US$1 billion by 2020” figure. Also corrected when Ma met the Prime Minister – it was last year, not this year.

This post Alibaba grows empire yet again with South Asia acquisition appeared first on Tech in Asia.